Insight Into Private Licensed Moneylenders In Singapore

Quick Jump to

Quick Jump to

Understanding legal & licensed moneylenders in Singapore

What is a licensed moneylender?

A licensed moneylender is a registered, legal moneylender in Singapore that’s been authorised by the Ministry of Law’s Registry of Moneylenders to conduct the business of moneylending.

Only local moneylenders that have obtained their licences can operate as a legitimate licensed moneylender online and in-person at their registered business address.

What is the Moneylenders Act?

Authorised moneylenders in Singapore operate in accordance with the Moneylenders Act. The Moneylenders Act governs the regulation of money lending in Singapore, the designation and control of a credit bureau as well as the collection, utilisation and revelation of borrowers’ information and data for matters associated with the application for loans from moneylenders.

In short, it lists out all the legal confines within which legal moneylenders in Singapore are allowed to administer their business activities.

Where can you view the list of registered moneylenders in Singapore?

You can easily access the full list of registered moneylenders via the Registry of Moneylenders’ official list of registered lenders in Singapore.

According to MinLaw’s list, there are 154 legal moneylenders in Singapore as of time of writing. This figure may change from time to time as the list is updated periodically.

Borrowing from licensed moneylenders in Singapore

Advantages and disadvantages of borrowing from legal moneylenders

| Advantages of a loan from legal moneylenders | Disadvantages of a loan from legal moneylenders |

| Accessible to people from all walks of life, even those in the lower income group |

High interest and late interest charges of up to 48% per annum |

| Streamlined application process | Steep administrative fee of up to 10% of approved loan sum |

| Fast approval (usually under 30 minutes) | Short loan tenure of up to 12 months repayment period |

| Minimal documents needed | |

| Instant fund disbursement after contract signing |

|

| Open to those with poor credit rating |

What are the loan types available from private moneylenders in Singapore?

Private moneylenders in Singapore offer a wide range of loans catered to different personal and business needs. Case in point, 1-Cash offers the following loan types:

Personal loans

Renovation loans

Wedding loans

Wedding loans

Emergency loans

Emergency loans

Debt consolidation loans

Payday loans

Medical loans

Business loans

How much can you borrow on a loan from a licensed moneylender?

There are legal limits in place for the amount of unsecured loan you can get from licensed moneylenders. At any one point in time, the maximum amount you can borrow across licensed moneylenders is as follows:

| Your annual salary | Singaporean/ PR | Foreigner |

| <$10,000 | $3,000 | $500 |

| $10,000 to < $20,000 | $3,000 | |

| ≥ $20,000 | Up to 6X monthly salary | Up to 6X monthly salary |

Is it easy to get loans from private moneylenders in Singapore?

In general, it is very easy to get loans from private moneylenders in Singapore. In fact, there are many reliable private moneylenders in Singapore to choose from.

Do legal moneylenders extend loans to people with poor credit rating?

Yes, legal moneylenders in Singapore are inclusive and highly accessible — they provide loans to individuals even if they don’t have the best credit rating.

Who can get a loan from a licensed private moneylender in Singapore?

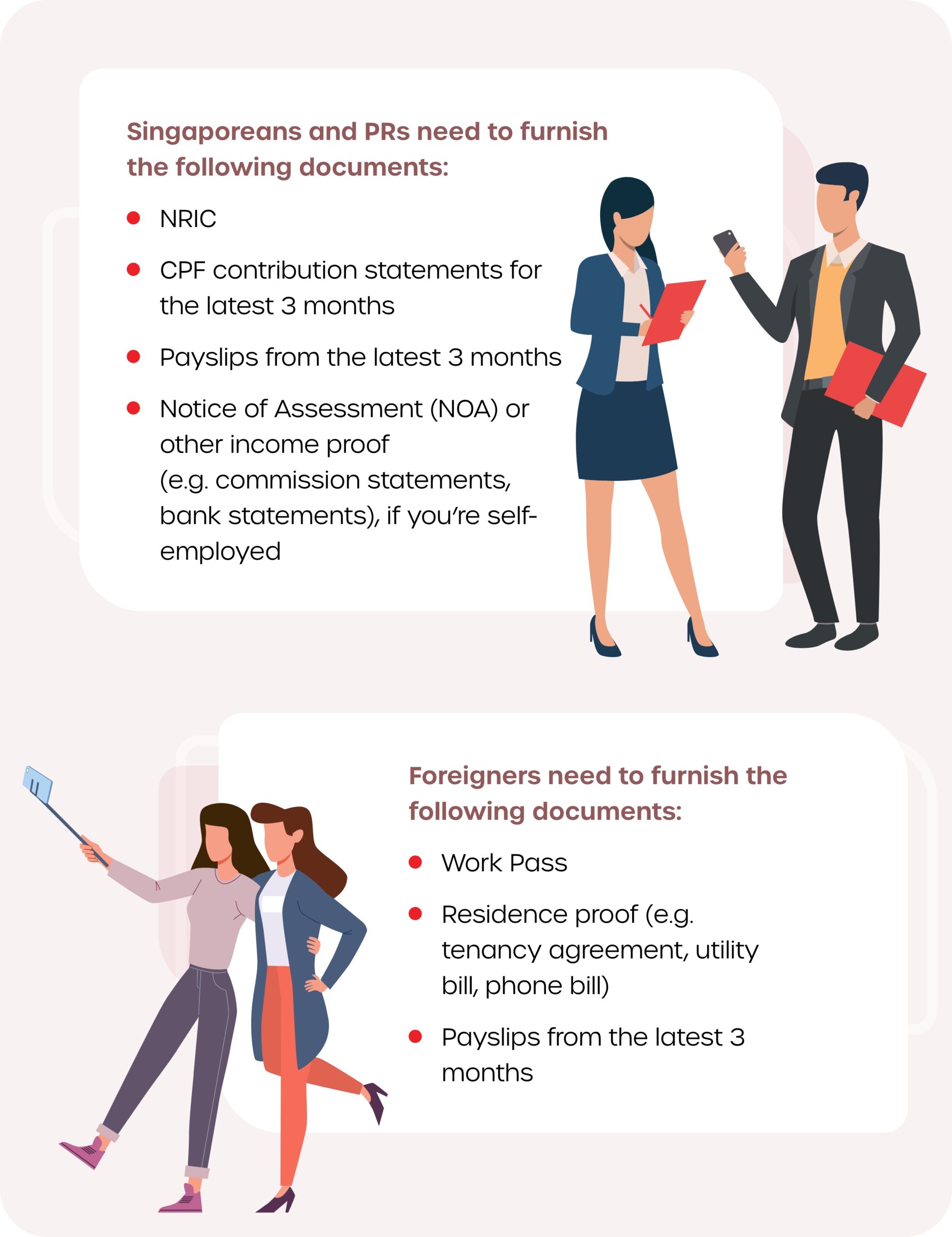

Singaporeans, Permanent Residents and Foreigners working in Singapore can get a loan from a licensed private moneylender in Singapore as long as they are:

- 18 to 65 years old;

- Employed full-time or self-employed;

- Able to furnish evidence of consistent income

- Not bankrupt, under bankruptcy proceedings, under Debt Repayment Scheme, or undergoing litigation

Can an unemployed person get a loan from licensed private moneylenders in Singapore?

This may come as a surprise but an unemployed person can get a loan from licensed private moneylenders in Singapore as long as he or she is able to show evidence of consistent income.

This ‘income’ can be alimony, dividends, annuity payouts or monthly retirement plan payouts, etc. The ability to furnish statements showing such ‘income’ will be very helpful in the process of determining whether or not you’re suitable for a loan.

What are the documents needed for loans from legal moneylenders in Singapore?

Do licensed moneylenders provide loans to borrowers without a credit check?

No, licensed moneylenders do not provide loans to borrowers without a credit check. While legal moneylenders in Singapore are much more lenient compared to major banks —and they offer loans to those with poor credit scores— lawful quick moneylenders will still spend some time doing a credit assessment to determine your suitability for a loan.

The licensed moneylender will check on your borrowing limit and creditworthiness via your Loan Information Report at the Moneylenders Credit Bureau (MLCB).

What are the interest rates and late charges that reliable moneylenders in Singapore can charge?

All licensed moneylenders in Singapore have strict limits to follow:

Max. interest rate:

4% per month

Max. late interest rate:

4% per month

Max. late fee:

$60 for every month of overdue payment

Max. administrative fee:

10% of the approved loan principal

Note: If your loan principal is $5,000, the total interest, late interest, late fee and administrative fee chargeable cannot be more than $5,000.

How do legal moneylenders in Singapore compute their interest charges on a loan?

Legal moneylenders in Singapore employ the reducing balance method to compute interest charges on a loan. This means that interest is calculated based on the outstanding balance. As you pay down your loan by making punctual repayments, the amount of interest paid per instalment decreases, too.

This is different from a simple interest calculation using the flat rate method where interest is calculated based on the original loan principal.

Example: Assume you take a loan of $5,000 at a 24% per annum interest, with a loan tenure of 12 months.

| Reducing Balance Method | Flat Rate Method | |

| Interest rate per annum | 24% | 24% |

| Loan principal | $5,000 | $5,000 |

| Loan tenure | 12 months | 12 months |

| Total interest on the loan | $673.57 | $1,200.00 |

All things equal, a reducing balance loan results in lower total interest charged compared to a flat rate loan.

Does legal moneylenders’ late interest accumulate daily?

Yes, late interest on a moneylender’s loan accumulates on a daily basis, as does compound interest.

Daily late interest rate = moneylender’s annual interest rate / 365 days

Daily compound interest rate = moneylender’s annual interest rate / 365 days

Late interest is computed based on the overdue outstanding payment amount while compound interest is computed based on the overdue principal amount owed.

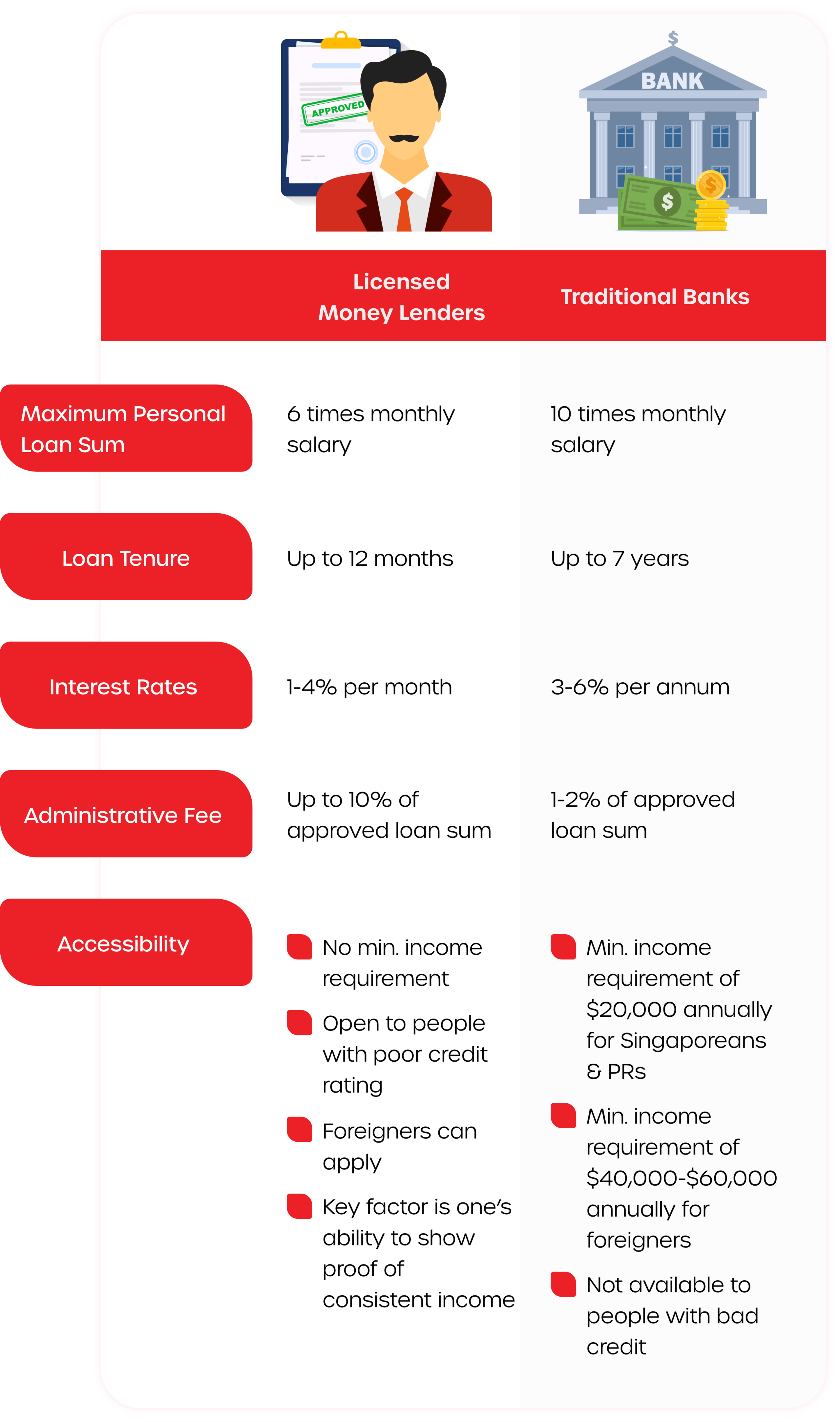

Licensed moneylenders vs traditional banks

In today’s day and age where scams are aplenty, make sure to only borrow from banks and trusted moneylenders in Singapore, even if you need to get hold of emergency funds as quickly as you possibly can.

There are important things you need to know about borrowing from licensed moneylenders. Here’s a quick look at how borrowing from licensed moneylenders compares with borrowing from traditional banks.

Licensed Moneylenders

Traditional Banks

Maximum Personal Loan Sum

6 times monthly salary

10 times monthly salary

Loan Tenure

Up to 12 months

Up to 7 years

Interest Rates

1-4% per month

3-6% per annum

Administrative Fee

Up to 10% of approved loan sum

1-2% of approved loan sum

Accessibility

- No min. income requirement

- Open to people with poor credit rating

- Foreigners can apply

- Key factor is one’s ability to show proof of consistent income

- Min. income requirement of $20,000 annually for Singaporeans & PRs

- Min. income requirement of $40,000-$60,000 annually for foreigners

- Not available to people with bad credit

What should you consider before taking a loan from a legalised moneylender in Singapore?

Ensure you are clear on all of the loan terms and conditions before signing the loan contract. The loan contract you enter with any legalised moneylender in Singapore is legally binding.

Consider if your finances are sufficient to service the loan from a moneylender — weigh your income and various monthly financial obligations, including fixed living expenses and loan repayments.

Late payment charges as well as late interest will be charged on late repayments.

By law, a legalised moneylender in Singapore is required to fully explain the loan contract to you in a language you’re comfortable with and can understand.

It is always good practice to clarify any questions regarding your loan contract, such as monthly repayment amount, repayment date, loan tenure, interest charges, etc.

An authorised moneylender in Singapore needs to give you a copy of your loan contract.

Don’t rush into getting a quick moneylender loan; compare licensed moneylenders online before choosing a reliable moneylender in Singapore to borrow from.

How can you know if you’re applying for a legal moneylender loan from a licensed moneylender online?

Do a quick check on the licensed moneylender online by looking for the moneylender’s name in MinLaw’s official list of legitimate moneylenders in Singapore.

Compare the moneylender’s office address, licence number and landline number with the details stated in the list, too. Make sure they tally!

Just so you know, a licensed moneylender online is NOT allowed to:

- Use calls/ SMS/ WhatsApp, Telegram, and other social media platforms to solicit loans

- Demand an upfront fee to process your loan

- Approve and disburse a loan remotely, without having you meet the moneylender at their registered business premise

Tip:

Illegitimate moneylenders typically push to transact fully remotely. If you encounter a local moneylender that refuses to meet you in person at their registered business address, drop all communication with the lender and do not proceed further.

What are licensed moneylenders allowed to do?

Apart from extending reasonable, transparent and fair moneylender loans to borrowers that fall within the various limits they must comply with, licensed private moneylenders in Singapore are only permitted to utilise the few advertising channels listed below to market their money lending services:

On their own official website(s)

On their registered office’s shopfront as well as window decals and office interior

In consumer or business directories

These legal but private moneylenders in Singapore are allowed to take the following steps to recover the money loaned to you in the event that you skip your repayments:

Serve you a Letter of Demand by mail or in-person

Visit your home or workplace

Engage professional debt collectors to collect debt on their behalf

Initiate legal action against you

Should legal action be taken against you, you’ll be liable for the court-ordered legal costs incurred by the moneylender to recover the money owed to them if the moneylender is successful with the reimbursement claim.

What are the things licensed moneylenders are not permitted to do?

There are many things licensed moneylenders are not allowed to do. Here’s a quick glance at what they are not authorised to do:

- Get people to apply for loans by initiating contact via messaging apps, texts, social media platforms, etc

- Advertise online on websites not owned by the moneylender

- Demand your Singpass login credentials

- Hold on to your NRIC or other official personal ID documents

- Provide loans without caring to clarify or explain loan terms

- Provide loans without caring if the borrower truly understands all terms and conditions

- Get a borrower to commit to an empty or partially done Note of Contract for the loan

- Not giving a copy of the signed loan contract to the borrower

- Hastily approve and disburse loans remotely without doing a proper credit check or face-to-face meeting with the borrower

- Demand the payment of the administrative fee even before the loan is processed

- Overcharge borrowers on interest and fees for the loan

- Impose late interest charges on amounts that aren’t due for repayment yet

- Threaten borrowers with violence

- Verbally or physically abuse borrowers

- Hound borrowers

What can you do if you experience licensed moneylenders’ harassment?

Licensed moneylenders’ harassment should not happen. If you encounter such distressing behaviours, be sure to file a complaint with MinLaw’s Registry of Moneylenders as soon as possible. You can do so by filling out their online complaint form or calling them at 1800-2255-529.

Burning questions about licensed moneylenders in Singapore, answered

Not all private moneylenders in Singapore are quick moneylenders and/ or reliable moneylenders in Singapore. Case in point, illegal moneylenders are considered private moneylenders but they are certainly not reliable. Avoid illegitimate moneylenders at all costs!

Apart from family and friends, one should only borrow from a bank or legal moneylender in Singapore.

Instant moneylenders offer incredibly quick loan processing, approval and fund disbursement altogether but these instant moneylenders still need to meet you in person to verify your identity at their registered moneylender’s office.

The best quick and reliable moneylenders in Singapore can provide you with instant approval and cash disbursement in under 30 minutes if all required documents are in place.

Even though legal moneylenders in Singapore let you apply for loans on their websites that run 24/7, their offices do not operate on a 24-hour basis. All online moneylenders in Singapore have fixed opening hours for their registered offices.

Not all online moneylenders in Singapore are trustworthy. There are many authorised local moneylenders in Singapore that offer their services online and can be wholly trusted, as well as many unlicensed moneylenders that should be avoided at all costs.

Note that reliable online moneylenders in Singapore have an online presence and typically let you apply for loans securely on their website, often integrating with Singpass capabilities to maximise convenience for their borrowers.

To get your cash loan from a moneylender, you’ll still need to visit the legal moneylender’s business premise to sign your loan contract in person first.

Debt consolidation loans from moneylenders can come in handy if you’re struggling to manage multiple concurrent debts. Think of it as a type of personal loan that lets you consolidate several debts into one, so that you only have to make a single repayment every month.

Not only is it easier to keep track of just one monthly repayment amount and due date, but also it usually helps reduce the amount of interest chargeable. This is especially true if you’ve been lagging behind in making repayments for your multiple debts!

Not all licensed moneylenders are open for business on Sunday. If you’re in the Tampines region, you’ll be happy to know that 1-Cash is open from 11am to 5pm on Sunday, 11am to 7.45pm from Monday to Saturday.

How to find highly rated legitimate moneylenders in Singapore?

To find highly rated legitimate moneylenders, be sure to do your research thoroughly. Search for ‘registered moneylenders in Singapore’ or ‘authorised moneylenders in Singapore’ online and read reviews on these local moneylenders.

Also, ask around if you have friends and family who’ve had experience borrowing from licensed moneylenders to learn more about these private moneylenders in Singapore.

Is it easy to find fast moneylenders?

Yes, if you know where to look. 1-Cash is one of the fast moneylenders you can approach for fast loan approval and fast loan disbursement. If all required documents are in place, you can expect to get your loan in under 30 minutes.

Get a quick moneylender’s loan for your urgent cash needs

What sets 1-Cash apart from other licensed moneylenders?

1-Cash is a reliable online moneylender in Singapore you can count on. We are an established, trusted moneylender in Singapore’s local moneylenders’ scene with more than 17 solid years of experience in the money lending business.

How to apply for a private moneylender loan with 1-Cash?

To apply for a private loan from 1-Cash, a legal moneylender in Singapore, all you have to do is follow these simple steps:

Apply now on our website via Singpass

Our loan officer will contact you to arrange for a face-to-face meeting at our office

Get loan approval after a quick credit assessment (bring all required documents!)

Scrutinise all terms and conditions of the loan contract before signing

Get instant cash or opt for a bank transfer

That’s how easy it is — five simple steps.

Worried about your privacy? Throw that concern outside of the window. Here at 1-Cash, we value and strive to protect your privacy and personal information at all costs. All data will be handled with the strictest level of confidentiality.

Need a loan from a trusted moneylender in Singapore but not sure where to look?

It is safe to consider 1-Cash for your loan needs, no matter what your situation may be. We are one of the leading accredited fast moneylenders in the Eastern region of Singapore that offers quick loan application options: Singpass and a simple online form. Apply now to get hold of the emergency cash funds you need soonest!

Conveniently located in the heart of Tampines, 1-Cash is a stone’s throw away from Tampines MRT station. Don’t hesitate to visit us or reach out to us at your convenience should you need any assistance. We’re always here for you.

Quick Jump to