Singapore Licensed Moneylender

Best Legal Loan Company in Tampines

Hassle-free application

Fuss-free online application with Singpass.

Quick approval

Same-day loan approval and disbursement in 20 mins.

Flexible terms

Personalised loan tenures that suit your budget and needs.

Transparent rates

No hidden fees, 100% transparency.

1-Cash: Trusted Licensed Moneylender in Singapore for Over 17 Years

For over 17 years, 1-Cash has been a reliable presence in the money lending industry in Singapore, helping thousands with dependable financial solutions. As a licensed private moneylender in Singapore, our experienced loan consultants are dedicated to help you in planning your finances for a secure financial future.

Our Commitments to You: Reliable and Personalised Legal Money Lending

1-Cash isn’t just about loans; we’re about responsible financial empowerment. As a legal moneylender in Tampines, we collaborate with local social service agencies to assist those in financial difficulty.

Our mission is also to educate and protect vulnerable individuals from scams, helping them make informed financial decisions. We are a licensed moneylender that prioritises transparency and integrity in all services.

Why Choose Us as Your Preferred Private Loan Company in Singapore?

We are a licensed moneylender in Tampines that takes regulatory compliance seriously. Our company undergoes annual reviews by the Ministry of Law (MinLaw) to uphold the highest standards. We are here to meet your short term lending needs. Whether you’re seeking inclusive financial support, personalised repayment options, or a convenient location, 1-Cash has you covered.

Our Tampines office, just 100 metres from Tampines MRT, is easily accessible. You can also conveniently submit your loan applications through our website, which is available 24/7. After applying online, you need to only visit our moneylender office for in-person verification to complete your application.

Choose 1-Cash—your credible private moneylender in eastern Singapore—and embark on a journey towards a brighter financial future.

Customer Reviews

Our Office

Range of Loan Options

Personal Loans

Renovation Loans

Debt Consolidation Loans

Wedding Loans

Emergency Loans

Payday Loans

Medical Loans

Business Loans

Features and Benefits

Low interest rates:

1 - 3.92% monthly*

Flexible repayment plans:

Up to 12 months or more*

Transparent pricing: No

hidden fees

Quick approval:

Get approved in as little as

20 mins

*Terms and Conditions Apply

How to Apply for a Loan with 1-Cash, SG’s Best Legal Moneylender:

Complete our online loan application form using Singpass for a quick and secure process, or visit our office near Tampines MRT to apply in person.

Our friendly loan consultant will contact you to arrange an appointment at our Tampines office, ensuring service tailored to you.

Get fast approval and sign the contract. Receive funds immediately through a bank transfer or in cash, making it convenient for you.

Required Documents for Loan Applications with Licensed Moneylenders:

For Singaporeans

Employees

- Original IC (Identity Card)

- Your Singpass credentials

Self-employed

- Original IC (Identity Card)

- Your Singpass credentials

- Proof of income (e.g., bank statements, income slips)

For Foreigners

Employees or Self-employed

- Your Singpass credentials

- Work Pass

- Utility bill

- Proof of income (e.g., bank statements, income slips)

FAQs

Explore common questions about licensed moneylenders in Singapore

What is the purpose of the Moneylenders Act?

The Moneylenders Act not only serves as the legal framework outlining what licensed moneylenders in Singapore can and cannot do, but also sets rules for how borrowers’ data is handled during loan applications with authorised moneylenders in Singapore.

What exactly is a licensed moneylender?

Licensed moneylenders in Singapore are approved and regulated by the Ministry of Law’s Registry of Moneylenders. Only legitimate lending companies with a valid moneylender’s licence are allowed to conduct their moneylending business at their registered address.

How do I check for registered moneylenders in Singapore?

The complete list of registered moneylenders can be found on the MinLaw website; currently, there are 153 licensed moneylenders listed. This figure may be updated periodically.

How much am I eligible to borrow from a licensed moneylender in Singapore?

| Borrower’s annual income | Singapore Citizens and Permanent Residents | Foreigners residing in Singapore |

|---|---|---|

| Less than $10,000 | $3,000 | $500 |

| At least $10,000 and less than $20,000 | $3,000 | $3,000 |

| At least $20,000 | 6 times monthly income | 6 times monthly income |

How much interest and late fees can a reliable moneylender in Singapore legally charge?

To protect borrowers, all licensed moneylenders in Singapore are subject to strict regulations regarding the private money lending rates and fees they can impose:

Max. interest rate:

4% per month

Max. late interest rate:

4% per month

Max. late fee:

$60 for every month of overdue payment

Max. administrative fee:

10% of the approved loan principal

Note: If your loan principal is $5,000, the total charges, including interest, late payment interest, late penalties and administrative fees, cannot exceed $5,000

What are the eligibility criteria to obtain a licensed moneylender loan?

The standard eligibility criteria for loans from a licensed moneylender in Singapore generally include:

- Age: Applicants must be between 18 and 65 years old.

- Residency/Work Status: Applicable to Singapore Citizens, Permanent Residents, and Foreigners holding valid work passes.

- Credit Profile: Individuals with weak credit standing are welcome.

- Employment Type: Salaried employees, business owners, and self-employed individuals (including freelancers, gig workers like delivery riders or PHV riders, and professionals with variable income, such as insurance or property agents).

1-Cash is a preferred licensed moneylender in Singapore known for providing accessible financial solutions customised for diverse needs. Contact us to learn more.

Can borrowers get a loan from a licensed moneylender without undergoing a credit check?

No, loans from licensed moneylenders in Singapore cannot be issued without a credit check. While legal moneylenders in Singapore generally have more lenient criteria than banks and are more accommodating to those with less-than-perfect credit, they are still obligated to conduct a credit check to establish your borrowing limit and creditworthiness.

Are loans from licensed private moneylenders in Singapore available to unemployed individuals?

This may come as a surprise, but unemployed individuals may still qualify for loans offered by licensed private moneylenders in Singapore if they can demonstrate a stable source of income. This may include alimony, dividend earnings, retirement payouts, or annuities.

Providing clear documentation of such income can significantly support your loan application. Note that not all authorised moneylenders in Singapore offer this — check with your moneylender for good measure!

Do legal moneylenders offer loans to borrowers with less-than-ideal credit scores?

Absolutely! Legal moneylenders often focus on your ability to repay instead of scrutinising your credit score, so you might still qualify for a loan even with a less-than-perfect credit history.

In fact, when you apply with 1-Cash, you’ll be able to take up a variety of loans — from bad credit loans, monthly loans, to business loans.

Am I eligible to take up a new loan with a licensed moneylender if I’m currently servicing an existing loan?

Yes, you may apply for a new loan even if you’re currently repaying an existing loan with a licensed moneylender. However, we advise you to carefully review your obligations to ensure you stay within your financial means.

Will I be penalised if I settle my loan early with a licensed moneylender?

No. Licensed moneylenders can only impose these specified fees, effective from 1 October 2015:

- A fee not exceeding $60 for each month of late repayment.

- A fee not surpassing 10% of the principal amount upon loan approval.

- Court–ordered legal fees, if the moneylender succeeds in claiming for loan recovery costs.

Are my personal details protected if I borrow from a licensed moneylender in Singapore?

Absolutely! At 1-Cash, safeguarding your personal data is one of our top priorities as a legal and licensed moneylender in Singapore. We adhere to strict data protection laws and use the latest security systems to ensure your information remains confidential.

Additionally, our systems are routinely monitored to prevent unauthorised access, so you can rest assured that your details remain private and secure throughout your loan journey with us.

How is loan interest calculated by legal moneylenders in Singapore?

The reducing balance method is used by licensed moneylenders in Singapore to calculate loan interest, where interest is only charged on the outstanding loan balance. As timely repayments are made, your outstanding loan amount reduces, which decreases the interest paid per instalment. This differs significantly from the flat rate method, which calculates interest solely based on the loan principal sum.

Example: Assume you take out a loan of $5,000 at an interest rate of 24% per annum, with a loan tenure of 12 months.

| Reducing Balance Method | Flat Rate Method | |

|---|---|---|

| Interest rate per annum | 24% | 24% |

| Loan principal | $5,000 | $5,000 |

| Loan tenure | 12 months | 12 months |

| Total interest on the loan | $673.57 | $1,200.00 |

Suppose all other factors are the same, a reducing balance loan incurs lower total interest charges than a flat rate loan.

Do legal moneylenders in Singapore apply late interest charges daily?

Yes, licensed moneylenders apply late interest daily using the following formula:

Daily overdue interest rate = Annual interest rate / 365 days

Daily compound interest rate = Annual interest rate / 365 days

Note that late interest is levied on the overdue amount, while compound interest is applied to the overdue unpaid principal amount.

Can I easily apply for a loan with private moneylenders in Singapore?

Absolutely! Private moneylenders in Singapore offer a more streamlined borrowing process compared to traditional banks. With faster approvals and more flexible requirements, licensed moneylenders are ideal for borrowers with urgent financial needs.

Do licensed moneylenders in Singapore submit borrower information to credit reporting agencies?

Payment records will be reported to MLCB (Moneylenders Credit Bureau), but they will not be reported to CBS (Credit Bureau Singapore).

What would happen if I missed a repayment to a licensed moneylender in Singapore?

Licensed moneylenders in Singapore may charge a maximum of 4% per month on the overdue amount and up to $60 monthly in late fees. The exact rates are specified in your loan contract.

What are the repercussions of defaulting on a loan repayment to a licensed moneylender in Singapore?

A loan default leads to snowballing debt and negative repercussions on your MLCB credit report, which will likely hinder future loan applications. Legal action is also a potential outcome. If you anticipate difficulties with loan repayment, please contact us immediately so that a viable repayment plan can be arranged.

What steps should I take if I encounter financial challenges after obtaining a loan from a legal moneylender in Singapore?

If you’re unable to pay a moneylender in Singapore, consider approaching your licensed moneylender to renegotiate your repayment terms. Help is also available from social service organisations, which offer debt management guidance, credit counselling services, and support in negotiating with creditors.

What are the key considerations before borrowing from a licensed moneylender in Singapore?

Avoid committing to a loan with a licensed moneylender right away — be sure to review the private money lending rates, repayment terms and fees involved. Also, confirm that the lender is on the MinLaw’s list of licensed moneylenders to ensure legitimacy.

You should also assess your finances carefully and examine factors such as your salary, expenditures, and the potential impact of late payment charges, which will apply to overdue repayments. Always compare licensed moneylenders to identify the most suitable option.

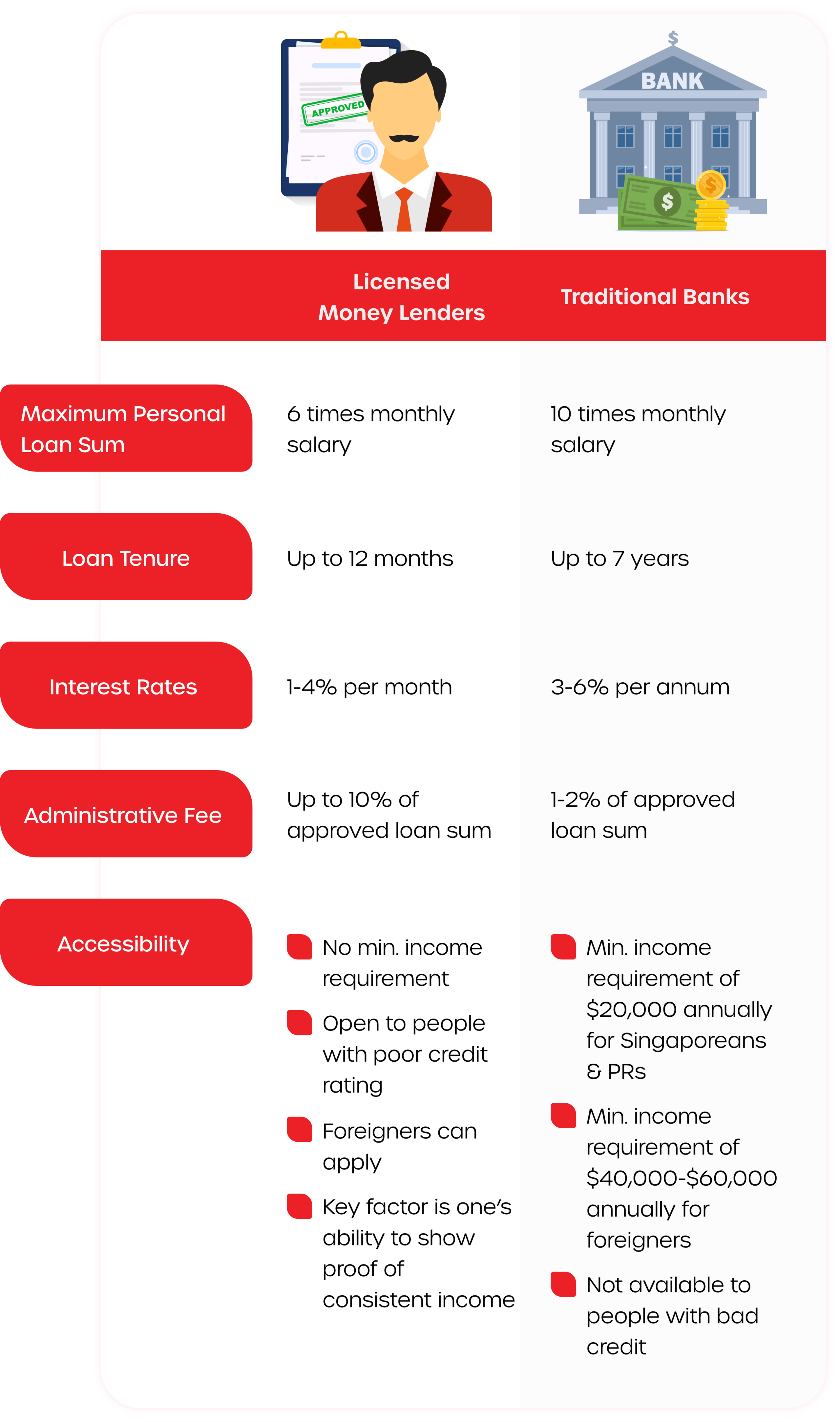

How do licensed moneylenders differ from banks?

With scams on the rise, it’s crucial to only borrow from banks and trusted moneylenders in Singapore, even if you’re in urgent need of funds.

There are important things you need to know about borrowing from licensed moneylenders. Here’s a quick look at how borrowing from licensed moneylenders compares with borrowing from traditional banks.

Licensed Moneylenders

Traditional Banks

Maximum Personal Loan Sum

6 times monthly salary

10 times monthly salary

Loan Tenure

Up to 12 months

Up to 7 years

Interest Rates

1-4% per month

3-6% per annum

Administrative Fee

Up to 10% of approved loan sum

1-2% of approved loan sum

Accessibility

- No min. income requirement

- Open to people with poor credit rating

- Foreigners can apply

- Key factor is one’s ability to show proof of consistent income

- Min. income requirement of $20,000 annually for Singaporeans & PRs

- Min. income requirement of $40,000 – $60,000 annually for foreigners

- Not available to people with bad credit

Do instant moneylenders disburse funds right away?

Instant moneylenders are known to be incredibly quick in reviewing, approving and disbursing loans; however, in-person meetings at their registered business premises are still necessary for identity verification.

Quick and reliable moneylenders in Singapore may approve and release funds in as little as 30 minutes, provided that supporting documents are duly submitted.

What activities are permitted for licensed moneylenders?

In addition to offering fair and transparent loans within regulated limits, licensed private moneylenders in Singapore are only allowed to utilise the following approved advertising channels:

On their own official website(s)

On their registered office’s shopfront as well as window decals and office interior

In consumer or business directories

In the event of missed repayments, legal private moneylenders in Singapore may take the following actions to recover the loan amount:

Serve you a Letter of Demand by mail or in-person

Visit your home or workplace

Engage professional debt collectors to collect debt on their behalf

Initiate legal action against you

Should a moneylender win a lawsuit against you, you will be liable for the court-ordered legal fees for their debt recovery efforts.

What actions are licensed moneylenders prohibited from taking?

In Singapore, licensed moneylenders cannot charge exorbitant interest rates, use aggression and intimidation to recover debts, or resort to deceptive practices. Legal private lenders are also required to provide clear and transparent loan agreements to protect borrowers.

Here’s what licensed moneylenders are not authorised to do:

- Reaching out to individuals via social media platforms or unsolicited messages

- Advertising on unauthorised websites that they do not own

- Demanding Singpass login details or keeping borrowers’ NRIC or official ID documents

- Failing to explain loan terms adequately before issuing loans

- Allowing borrowers to sign on incomplete or blank contracts or withholding signed copies

- Approving and disbursing loans without conducting credit assessments and in-person interviews

- Imposing fees upfront before loan approval

- Applying excessive interest charges or fees, or imposing late charges on amounts not due

- Resorting to threats, verbal or physical abuse, or harassment against borrowers

What can I do if I get harassed by a licensed moneylender in Singapore?

Do not suffer in silence if you ever encounter harassment from licensed moneylenders — call 1800-2255-529 or file an online complaint with the Registry of Moneylenders.

Learn more about your rights and protections against licensed moneylender harassment to better safeguard yourself today.

Can all private moneylenders in Singapore provide fast and dependable services?

Not every private moneylender in Singapore offers speedy or reliable services. For example, illegal moneylenders are considered private moneylenders, but they are certainly not trustworthy. Steer clear of illegitimate moneylenders!

Apart from family and friends, one should only borrow from a bank or a licensed legal moneylender in Singapore. It will also be helpful to familiarise yourself with the telltale signs of moneylender scams.

What should you check to confirm the legitimacy of a licensed moneylender online?

Verifying the legitimacy of a licensed moneylender online is simple — just look up the moneylender’s name in MinLaw’s list of legitimate moneylenders in Singapore. Confirm that the details provided by the lender (business address, licence number, landline) align with the records in the list.

Keep in mind that a licensed moneylender online would NOT:

- Offer unsolicited loans via social media platforms, Telegram, WhatsApp, or calls

- Request upfront payment before loan processing

- Release funds without an in-person meeting at their registered office

Pro tip: If a lender is insistent on transacting online and turns down your request to meet in person, it’s a red flag. Cut off all contact with them immediately.

Can you find any legitimate online moneylenders in Singapore that operate 24/7 online?

Convenient 24/7 online loan applications are offered by most legal moneylenders in Singapore, but it’s important to note that they do not provide in-person services around the clock. All legitimate online moneylenders in Singapore have fixed opening hours for their registered offices.

Do licensed moneylenders conduct business on Sundays?

Licensed moneylenders aren’t always open on Sundays, but if you’re in the Tampines region, you’ll be happy to know that 1-Cash is open from 11 am to 5 pm on Sundays, and 11 am to 7:45 pm from Monday to Saturday.

Can online moneylenders in Singapore be trusted?

Be vigilant when seeking online moneylenders in Singapore. While many authorised local moneylenders can be found online, unlicensed moneylenders do exist, and you should steer clear of them. At the same time, keep a lookout for blacklisted moneylenders — while they were previously legal lenders, they have flouted the rules and hence, it’s advisable to stay away from them.

Note that reliable online moneylenders in Singapore typically have an online presence and allow secure loan applications on their websites, often integrating Singpass capabilities to maximise convenience for their borrowers.

To receive your cash loan from a moneylender, an in-person visit to the legal moneylender’s business premises is required for identity confirmation, quick credit assessment, and contract signing.

Where can I find reliable and well-reviewed legitimate moneylenders in Singapore?

Thorough research is required to identify highly rated and legitimate moneylenders. Search for ‘registered moneylenders in Singapore’ or ‘authorised moneylenders in Singapore’ online and read reviews of these local moneylenders. Personal recommendations from acquaintances with prior borrowing experience from licensed moneylenders can also be helpful.

If you’re looking for a highly rated and legitimate moneylender offering cheap loans in Singapore, 1-Cash is an ideal choice!